Usually I write about stuff that I recommend doing. In this post, I want to look at something that is possible, but not recommended under most circumstances. With hard economic times, there are a lot of people trying to find ways to borrow from their retirement funds. Many 401k accounts allow this, but what if your money is in an IRA? You’ll probably want to ask: “Can I borrow from my IRA?” Well, can you borrow from your IRA? Or perhaps, can you borrow against your IRA’s value? Technically, no. But there is a short-term loophole that you can use if you have no other option. In this post, we are going to explore the loophole.

Individual Retirement Accounts

An individual retirement account is a retirement account that you set up personally. The government created this to make it easier for people to invest money for retirement when their employers didn’t offer retirement accounts. Basically, when you contribute to an IRA, you don’t have to pay taxes now on the amount you put in. You have to pay taxes when you take it out. (A Roth IRA works in the opposite way–you pay taxes now, but not later.)

There are a number of stipulations and rules associated with it, but the two we are concerned about for this discussion are the rules related to borrowing. You aren’t allowed to use the IRA for collateral, so you can’t borrow against your IRA. You can’t borrow money directly from the IRA, either. If you take the money out before retirement, you have to pay taxes on the amount you took out, plus a 10% penalty. (There are a couple of exceptions where you can avoid the 10% penalty.)

Getting a loan from your IRA

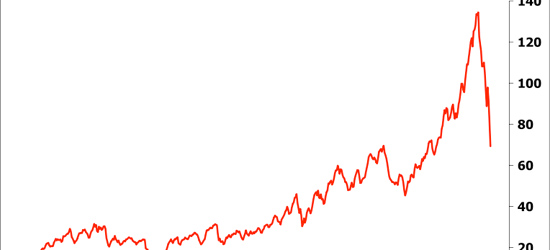

However, the government does let you roll your IRA over from one account to another. Usually you do this by requesting a check from the old account and depositing it into the new account. The law says you have 60 days to accomplish the transfer. This is the loophole. The 60-day period is basically be a 60-day loan of the value in your IRA.

The 60-day rule isn’t there to let you take a loan, it is just there to let you transfer the money elsewhere. For most people looking for a way to borrow money from their IRA, this loophole is a really really bad financial idea. People looking for this type of loan are under financial distress with problems that aren’t going to suddenly clear up in 60 days. If they pull the money out, spend it and don’t pay it back they are going to be in a position of owing the IRS a significant amount of the IRA’s value. Assuming 30% tax rate, pulling out $10,000 would generate a $4,000 tax bill. Further, bankruptcy can wipe out a lot of bills and debts that cause financial distress, but not anything you owe to the IRS. So if you temporarily use the IRA money to pay other debts and then go bankrupt, you now have a debt that stays with you through bankruptcy.

When to borrow against your IRA

So, why would you want to use the 60-day rule to borrow money? The only way I can think of is if you had some type of financial opportunity that you wanted to take advantage of, but it would take you more than 60 days to arrange financing. For example, if you found your dream home as a foreclosure and wanted to quickly make a cash offer to a bank, you could potentially pull the money out of your IRA to buy the house, and then get a mortgage on the home to pay it back. There is still risk involved. Here are some things to ask yourself:

- Do you know you can obtain financing elsewhere?

- Are you sure you can complete the other financing approvals within 60 days?

- Are there any possible roadblocks you haven’t foreseen?

- Is it possible to borrow money elsewhere?

Even if you think you can pull it off, here are some things to watch out for:

- Setting up the IRA may take longer than expected. Make sure you know how long it takes from the time you give the broker a check to the time it shows up in your new account for IRS purposes.

- Understand the paperwork involved and have the account created ahead of time. You don’t want to take 61 days because the broker was sick or because you forgot about a holiday.

- Make sure you understand how long it will take to get your other funding and leave a margin for error.

So, even though this is possible, it is risky. If you need money, there are usually other options that come with much less risk. Here are a number of ideas:

- The original investment in a Roth IRA can be withdrawn without a penalty or taxes, so that might be an option.

- You may be able to borrow on margin against your stock portfolio.

- Don’t forget about family. There may be someone willing to loan you money where they aren’t going to charge you 40% if you take 61 days to pay it back.

So, there you have it–a way to borrow from your IRA. Once again, let me stress that 90% of the time, this is a very, very bad idea. However it is possible, and sometimes knowing what is possible can help you take advantage of rare opportunities that come your way.

VERY BAD ADVICE!!

Apparently you have not heard of mandatory withholding on IRA disbursements made directly to you. If the IRA custodian makes the check out to you they are required to withhold 20% of it for tax purposes.

So if you tried this rolling over $10,000 you would receive a check for $8000. You then have 60 days to deposit $10,000 into a new retirement account to avoid the taxes and penalty. So you have to then come up with $2000.

So where did the 20% go. If you do make the deposit adding in 20% of your own money then you will get that money back when you figure taxes for the year (i.e. April 15th of next year) so it ends up that you give the government an interest-free loan for the 20% amount.

The proper way to move retirement money is to do a transfer where the money either goes directly to the new custodian or if you get a check it is made out to the new custodian. In those cases no withholding is done.

See http://retireplan.about.com/od/taxes/a/mndtry_whldg.htm

And borrowing from your 401K is a bad idea as well. If you borrow and lose your job your loan becomes immediately due and payable or you will pay taxes and penalty on it.

I believe you can specify the amount you want to have withheld. Did that change recently?

I agree that in most cases, trying to do something like this is very unwise. I’ve only heard of one or two times where it actually made sense to try something like this.

Regarding the 401k/403b borrowing, I’m pretty sure it doesn’t become immediately due if you lose your job as long as you continue to make the payments. I think the biggest risk is that you’ll miss out on significant market growth.

You do NOT have to have the taxes or the penalty immediately withheld. From very recent first hand experience with Fidelity, I was able to withdraw IRA money using a few mouse clicks with NO immediate withholding (you can reduce the 10% default withholding to 0%). You can move the cash from your IRA into a discretionary account (at same bank, in same day), and do something with it in the 60 day window (if you were willing to take the risk). But you’ll have to pay the greedy hand (IRS) eventually.

I have been considering doing this. My case is that I’m a software contractor with fluctuating income stream. It’s very possible I could get the money in payments within the 60 days. I agree though it’s rather risky and it’s just an emergency plan for me.

You might be better off converting your IRA to a Roth and pay the taxes on it. Then you can get the original investment out without taxes or the 10% penalty. I’m not sure if there is any type of waiting period before you can get your original investment out, but you might check with a CPA to see.

I am 78 years old and withdrew money from my IRA 3 times less than 60 days ago. I would like to repay that money. I had already reached my MWD several months ago.

The reason I want to pay it is so that my SS is not taxed as much as it would otherwise.

Can I repay that as long as I do so within 60 days? Does three withdrawals have any affect affect as long as I make the 60 day limit on all three?

You probably need to talk to a CPA just to be sure. Since you are past retirement age there may be other factors involved as well.

I have a 401k with Merrill Lynch. I lost my job but am now at a new. I still have the 401k but now my funds are now in mutual funds and other is cash about $23k which I would like to take a loan out against that or other money which is close to $200k. I an not currently in a 401k with my new job. Can I still barrow money and do the pay back option which I think is 5%over 5 years. I want to do it as I’m $30k in debt my other choice is to file for bankruptcy I need answers on both or if you can’t mainly barrowing the money.

Talk to Merrill Lynch to see. I know that in some situations you can.

So this might be really basic question for most people, but when it comes to taxes I am lost. I cashed out my roth ira in ’09 as a result of severe financial crisis. I had taken quite a loss from the total I had invested (Roth was only 5 or 6 years old at the time). I figured I did not have to pay taxes on it because i LOST money. Do I pay taxes regardless? And does it matter that the money I was investing with was from an un-taxable annuity? Just received a bill from the IRS looking to recoup taxes and fees.

Regards

You are going to need to talk to a CPA about that. Generally money you put into a Roth is already taxed so if you take out the principle, you don’t create any type of taxable event. If I remember right, there are some exceptions where there may be some fees triggered. It seems (and I’m relying on my memory here) that this was most likely to happen if you rolled over a pretax retirement account into a Roth.

One thing you might look into (and another reason to talk to a CPA) is the provisions that allow you to reverse a Roth rollover. In some cases, people who did roll overs only to have the value of their accounts crash have some recourse in undoing the transaction and getting back some of the taxes that they paid to do the rollover. I don’t know what the time limit is to do something like that, but it is probably something you should ask about.

I had a catastrophic illiness that my insurance did not cover. I had to use money from my IRA’s. Do I get any type of a break due to medical bills?

As far as I know, no. But I would check with a CPA to be sure.

I have two retirement accounts: One is a 401k with my place of employment the other is a rollover retirement account that I opened up with a $12,000 dollar investment about 12yrs ago I’ve seen it go from good to bad and now I need some financial help and it shows a little over $19,000 100 percent vested in mutual funds. I only need $7000 to get ahead. Can I take it from the rollover account? Or should close it all together? I dont want to have to pay myself back like a loan and I’m ok with the 10% penalty

Don’t forget you’ll have the taxes AND the 10% penalty. Depending on your state taxes, you might end up paying 40% or more in taxes. It would probably be worth discussing with a CPA to make sure you can get the money in the most tax advantaged manner.

What if you want to use the money to start a business? I have a 403B from a previous employer with Lincoln Financial. I changed school districts ( I am a teacher) and I currently have a built in retirement plan. How is it possible to take out a loan to against or using the money in my 403b? My credit is low right now because of a repo on a motorcycle that I bought a few years ago. Suggestions? I need the money to purchase a truck for my business and a license that is forsale and have alternate income and would be able to pay the loan back pretty quickly. I am only looking to borrow around 11 grand of the 26 grand in my 403 b. Thoughts?

If your 403B plan supports it, you may be able to borrow against it through whoever administers your plan. You’d have to pay interest, but in most cases the interest will go back into your retirement account.

I have a 401k of now 7000 and a Roth IRA of now 27,000 I’ve been out of work for 3 years now.

maxed my savings and MM.. Cannot find a job.. have been told to re-invent my self, take things off my resume. did so and still unemployed. I need to borrow money against my IRA so my mortgage won’t fall behind, which is current . which do you suggest I borrow the money from, I am aware of 10% interest and penalties. I was thinking of 10k from the IRA. Will I be given 5 years to repay or untill next tax due date. Please explain the tax advantage manner.

I am over 60 years old and have both an IRA and a 401k. I need to borrow $10,000 for six months. Is it better to 1) take from IRA 2) take from 401k or 3) do a line a credit on my home?

If you take it out of your IRA you will have to pay tax on it plus an additional penalty. Borrowing against your 401k may be a better option if you have that as an option.

After being downsized in June 2011 and finding few opportunities in my field, I devoted my time to developing a new product and it is almost ready to hit the retail stores. I have been funding it from savings and it is now time to place a major order of inventory. I need to find a way to borrow $36,000 against one of my IRA’s without cashing in and getting penalized as I am about 4 years away from being able to make withdrawals. With the business plan that I have in place and the markets that I will serve…I should be able to repay the money back within two years. Any suggestions???

It is time that people considering a 401(k), 403(b) or 457 loan know the real facts:

1) Loan repayments are NOT double taxed. Since the amount borrowed is never taxed, the only portion of the loan repayment that is double taxed is the interest. Therefore, the net interest earned on the loan is lower than that paid, but probably greater than that earned today in the market, or money market account (where many of conservative 401(k), 403(b) or 457 investors park their accounts).

2) Plans and recordkeepers that are using modern loan operation systems no longer require full repayment at termination of employment. “Inactive” participants are allowed to continue repayment post termination of employment.

The 50 Million people who maintain outstanding credit card balances, with interest at 15%-20%, are better off transferring that debt to a 401(k) loan, with interest at prime or near prime, plus a small adminstrative fee, freeing up debt service to be redirected to retirement savings.

I actually did this for my parents a few years ago. They found their dream home and needed to close with cash ASAP. Their funds were at Schwab and they knew of this strategy. I also had friends at a bank I could rely on to get a mortgage started before we closed and fully funded within a few weeks. I was the one sweeting bullets getting things completed but I agree it has it’s risks.

Everything worked out in our case and my parents are very happy in their new home. There are also limitations on the fequency of doing this… I believe once every few years.

I borrowed $4000 from my IRA for a family emergency in December 2012. I asked then if this would show up on my 1099-R for 2013 and was told no, as long as I paid it back within 60 days. I received my 1099-R and the amount is included on the form. Now I’m being told that if I pay it back in 60 days that I can show proof that I paid it back and won’t have to pay taxes on the amount paid back. Can someone tell me if this is ocrrect information? If I’m still going to be liable for taxes on the unpaid amount I may as well keep it to pay the taxes that I will be responsible for. Help please!!!

You are probably going to need to talk to a CPA to find out how to show that it was paid back on your taxes. If you did a transfer, I’m pretty sure you’d get a 1099-R either way because the company that released the money won’t know anything about the company that you transfer it to.

I have a question can someone borrow from his 401K even quitting his or her job?

I previously borrowed $30k from my former employers’ 401k plan. I repaid the loan (with taxable deductions from my pay) Now I am disabled and not working and have withdrawn part of the funds.

So I was taxed on the repaid funds and now am being taxed again on the withdrawal..

Am I not understanding the rules correctly, or am I in fact being double taxed ?

You are not being double taxed. This gets somewhat confusing…what you did was to use some post tax earnings to pay back some loan amount. The money you earned..and paid taxes on …was used to pay back the loan. So the money you earned was taxed. It has to be taxed as it was income – you paid tax on that. The fact that you used that money to pay back the loan amount does not make the loaned money ‘taxed’. So when you eventually take out those ‘loaned dollars’ out as a withdrawl you are then paying taxes – one time – on that.

Let me cite an example, you need to keep in mind that the dollars involved in the loaned amount and the dollars you use to pay back the loan are in two seperate distinct pots.

Say you take out a $1000 loan…lets call that amount POT#1. If you contributed on a pretax basis, it has not been taxed. Now lets say you earn $1200 – call this POT#2 – you have to pay taxes on it…let’s say for simplicity you have to pay $200 tax on it – so you have $1000 in your pocket. You have to pay taxes on it – it is income.

Now you go and use the $1000 out of this POT#2 to pay back your loan – the loan that was in POT#1. You pay the loan back – so now your account is whole. Now when you eventually withdrawl that $1000 down the road form your 401k account – then you have to pay taxes on it. You are paying taxes on it – ONE TIME. The money you used previously to pay off the loan was a seperate POT of money that was taxed – but it had to be taxed since it was income – you paid taxes on that money, not on the loaned money.

Just keep in mind that there is ‘this money’ and ‘that money’…if you look at them as individual POTS then it is easier to resolve this mentally. It is confusing but mathematically it makes sense and you are not being double taxed on your paid back loan amount.

Hi Mark,

When I was working I took an early withdrawal from a 403b to buy the house I am in. That allowed me to keep the house I owned at that time as a rental This situation worked out very well even though I paid the 10% early withdrawal penalty and state and federal income tax. I continued to contribute to the 403b until I retired at age 58..

Now I am almost 63 and find myself in another somewhat similar situation. The rental is long gone but I am still in the house where I used the 403b funds as part of the down, now 20+ years. I want to buy a short sale home in the country and then sell this home after the purchase of the second home. I am eligible to do this with a conventional mortgage i.e. I have enough cash flow to have two mortgages via my pension and systematic monthly distributions from my roll over IRA. (I am not drawing SS)

Unfortunately my offer on the short sale is the second offer in line and will only succeed if the first buyers offer does not work out. They are trying to use VA financing so there is a possibility due to the more stringent appraisal requirements.. If I withdraw my offer using conventional mortgage financing and make a cash offer it would move me into first position. A cash offer also avoids any sticky repair issues a lender may require! My idea is pay cash for the short sale using cash on hand, selling some mutual funds, and a majority of the money coming from my IRA to fund the purchase. Then I’d like to repay the IRA after I sell my home, which, is in good shape and in a desirable area with a good sellers market.

All the information I see regarding this seems to be addressed folks wanting to use their IRAs while still working and generally ineligible to withdraw the funds. Do you have any thoughts on my idea?

Thanks,

Richard

Obviously you need to speak with a CPA. However in the past you could get access to your IRA funds for about 90 days by doing a roll over. Double check with a CPA because the rules may have changed. However if you don’t get it rolled over in time you get hit with a penalty, so there is a degree of risk involved.

Since he is over 59 1/2, why would he have to pay a penalty? It seems to me that if he didn’t pay it back within 60 days, he would only have to pay income taxes and no penalty at all.

I’m getting ready to buy a house, and family has agreed to loan me the 20% downpayment at no interest. However the bank won’t allow me to use an unsecured loan for the downpayment- family money has to be a gift, which this is not. Do you see a problem with me doing the 60-day rollover from my IRA for the 20% (which IS allowed by the bank), then borrowing money from family to pay back the IRA within 60 days?

That seems like something worth looking into. However, it is possible that somewhere in all the paperwork you sign for the bank you agree not to do something like that.

We are looking to buy a house and are in the process of selling our current house. For the 20 percent down we were going to take it out of our ira and then put it back within 60 days when we sold our house. Is that possible? There will be equity there to pay it back in full.

It should be possible, but keep in mind there is risk involved. I would talk to a CPA first to make sure there aren’t any special considerations for your situation.

I was laid off in 2012 from a six figure job., interviewing and hopeful but still nothing. We want to downsize, but not sure if we can get a new mortgage on my spouse’s teacher salary., since our savings is depleted. We have more than $600k in IRAs and are thinking of withdrawing up to half of it, while our tax rate is low this year, to buy the smaller retirement home where we can live comfortably on the teacher income if necessary. We are 55 years old. Make sense?

I have a question for you,

I borrowed money from my pension to purchase a home. I understand that once the check is cashed and not used I will be taxed. My question to you, If the deal with the purchase of the home falls through for any reason, the check clears in my account but because the deal fell through, can I send the money back to my pension and not get penalized? Is there some sort of a grace period?

When you take money out of an IRA you have a period of time that you can roll it over to another IRA. If you don’t do so within a certain number of days, then the tax and penalties apply. You’ll have to look at the rules for your pension because they may be different.

Hello – I am Patti and I am in the process of looking at homes to buy – my problem or question is – being that I am single and living in california – my credit is great my rating 727 but I need t0 buy a home a condominium is the smartest choice due to cost and really only needing a small place – problem is that if I go that way the banks will not do a FHA loan only conventional and that requires 20% down – I would love to say i have that amount but truthfully I do not – what are the penalties to borrow from my 401K /ira and is it even possible?? I am almost 52 and only have about 37,000.00 help :)

I know that some 403b accounts allow you to borrow from/against them. You might see if your 401k has something similar.

I would like to borrow from my Ira , mind you its 10,000 all that I put in without any interest accumulated. What is the penalty besides the tax and the %10 and will I have to pay back in 60 days?

I am 63 and receiving my SS retirement income as well as pension, because I had to quit my job to take care of my mom. I want to purchase a home and want to borrow against my IRA for the down payment… probably around $30,000. Is this wise to do at my age? I only have about $58,000 in my IRA but haven’t taken any distributions yet.

In 9/23/15 I transferred my 401(k) from a vanguard account I had to a PNC investment IRA. I’ve than did a withdrawal of the entire funds in 5/5/16 but put it back in my original IRA before the 60 days. I recently got my tax statement showing that I had the full amount of distribution but it also showed taxable amount on the same number. How do I correct that because I did put it back within the 60 days. I know you have 12 a month window to withdraw each time but when I rolled over from my 401k Vanguard account in 9/24/15 to my PNC IRA in 5/5/16 was I ok because the bank stated I won’t be penalized if I am transferring my 401k to an IRA.

Thank you;

Tom

You are going to need to talk to a CPA to make sure you get the right instructions.

I took out two small amounts from my IRA in May 2017 knowing I will be taxed and have to pay the 10%. I will be able to put back in or open a new IRA in 60 days but I know you can only do this once in a twelve month period and these were separate transactions so I don’t think I can do that. However, if I take a large amount out to put down on a house, as I know I have the money coming to put back in (or open a new IRA) will I be able to do that for the one large amount. Also, do I have to open a NEW IRA or can I put back into my current IRA.

Thank you Mark. LAE